E-commerce in Tanzania: A pursuit for the crazy?

On May 17th it was my privilege to be on a panel being hosted by Deloitte Consulting for HDIF Innovation Week #IWTZ. The key theme of the panel was the Role of E-commerce on the Digital Economy in Tanzania. Firstly, I commend the organisers for putting this together and shining a light on a much-deliberated frontier sector. Secondly, it was a pleasure to engage with my fellow panelists Sameer Hirji (CEO of Selcom/Duka Direct), Firas Ahmad (CEO of AzamPay/Sarafu) and Daniel Mhina (Head of Digital Finance at FSDT).

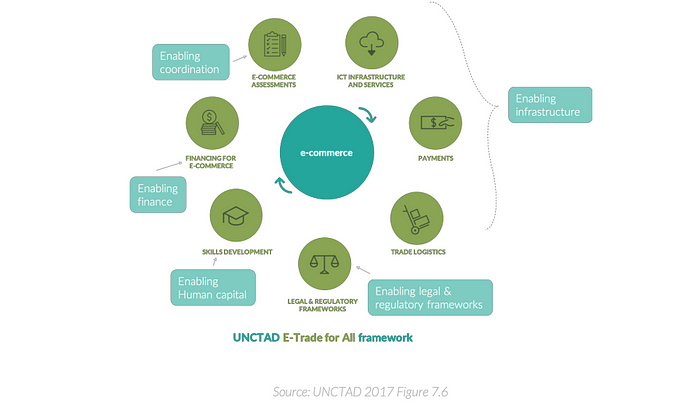

The context of the session was set by Daniel Materu (Technology Advisory Lead, Deloitte) by highlighting the definition of e-commerce, the key enabling factors that support a viable e-commerce sector and how Tanzania ranks against these indices. The bulk of the insight was supported by the UNCTAD B2C E-Commerce Index 2020 and The Mastercard Foundation Digital Commerce and Youth Employment in Africa Report 2019. Unsurprisingly, Tanzania ranked lowly in terms of having the appropriate enabling factors and was generally described as a high barrier market. It is this context that drove much of the conversation for the panel and was what became the lens through which participants submitted their questions.

Based on the above one could have left the discussion feeling that the outlook on the sector was poor, the barriers exceedingly high and the motivation to be engaged in the space a fool’s errand. For the record, I believe the prospects for e-commerce in Tanzania are blindingly bright and growth is an inevitability.

The unasked question — “Why are you involved in a business when the supposed enabling environment is so poor?”.

This is my attempt to respond to this elephant in the room. A few disclaimers first:

- I in no way fault the organisers of the panel. Conventional wisdom prevailed and as a primer on e-commerce in Tanzania the approach was totally justified.

- While I may make reference to my fellow panelists and their businesses, these are my personal views. Sameer and Firas may very well have the same perspective, but I cannot and do not intend to speak on their behalf.

So now to the why…

a) Consumer products in Tanzania have a long route-to-market and are required to pass through a complex chain of middlemen before they reach retailers or ultimately end consumers.

For upstream players along the value chain (Manufacturers/Importers) this creates a physical barrier to drive accessibility and penetration of their products. Through my experience of over a decade being involved in demand generation for consumer goods the unfortunate constant has been driving demand doesn’t necessarily correlate with driving sales.

Marketing and Sales/Distribution tend to be driven through siloed teams and processes and without an effective route to market strategy the ROI derived from marketing is minimal and largely untraceable. There are three primary ways upstream players distribute their goods; through distribution companies, directly to key accounts, directly via van sales.

Currently van sales and key accounts represent a small proportion of total volume and are an additional cost and business unit for upstream players. Distributors on the other hand are not all fulfilling their objective of maximising penetration. They focus on large customers which tend to be traditional wholesalers, have limited product knowledge or capacity in driving demand, have primitive methods of managing their routes which privileges institutional knowledge over data transfer and lastly are the arbiters of price elasticity in the market.

You will often find a distributor selling a product with 0-margin or lower to benefit from retro-trade incentives or well above recommended trade price when they foresee supply side shortages. This puts increased margin pressure on downstream players (retailers, Mangi shops) and results in nothing beyond a cohort of ‘staples’ (100–150 SKUs) ever being available in the last mile.

b) The typical procurement model for downstream retailers is to leave their business and source from the wholesale market. Fulfilment costs become sunk costs. Because wholesalers rarely bulk break, the retailer will also only procure the ‘staples’ which are known fast movers, although they may not present the best margin opportunity for the retailer.

Keep in mind that retailers depend on operating cash flow and generally will only hold a stock turnover of 2–3 days. Thus, your favourite corner store is trapped in a cycle of working to just restock, sinking the bulk of their thin margins into the phantom overheads of logistics, never being able to have a wide enough product mix to make it your sole source and ultimately in MSME purgatory.

Have you ever wondered why the Duka around the corner has remained the Duka around the corner for a decade?

The inequity baked into our routes to market are stagnating the growth of our retail industry as a whole. The top 1% stay on their perch, the 99% have clipped wings.

c) In developed markets the primary vector that drives consumers to e-commerce is convenience. While this also applies for a niche segment of salaried professionals in Tanzania — I do not believe this will be the dominant vector for the mainstream.

The reality is that any consumer-focused sector that has succeeded in Tanzania has done so on the back of pricing. Price sensitivity is expected when disposable income levels are limited. Our middle class is not the archetypal middle class of the white picket fence and 2.5 kids. Our middle class is young, recently urbanised, extremely aspirational but has to be broadly defined. If you have 5,000 Tsh to spend on consumer goods you are middle class. With the prospect of Dar-es-salaam alone becoming a mega city of 10,000,000 residents by 2030 this alone has the potential to be a massive market.

How does one manage to ensure that pricing is attuned to the capability of this middle class? Without sounding like a broken record — by fixing the routes to market. Cutting out the middlemen and being a conduit from the upstream players to the end consumer immediately unlocks increased choice and better price points. Furthermore, by being a retailer and a marketplace for other retailers we are able to create opportunities beyond the physical bricks and mortar footprint — supporting their efforts to scale.

So now getting back to the why. Firas rightfully mentioned that none of us involved in this space are going to be vacationing in Tahiti anytime soon. E-commerce is a tough business with a lot of operational complexity. Large investments need to be made to be able to scale to volumes that make a business sustainable. Barriers of prohibitive tariffs from payment providers, exclusivity and protectionist relationships with distributors and lagging regulation are real.

However, I am a militant optimist. I believe in equitable economies. I am also a student of the macroeconomic drivers of development. inalipa subscribes to the exact same values and we are extremely bullish about how the confluence of marketing/distribution/technology can and will create a new paradigm in our retail sector.

The fact that we are a developing country means constant value generation is intrinsic to our very existence and a necessity to our survival. We gravitate towards the hard things about hard things. We know that material changes to the lives of the 99% must happen. Not only do we want to tag along on the ride but be key actors in the evolution of our markets. We believe the ‘e’ in e-commerce is actually a misnomer and that the future of all commerce will be digital or digitally enabled.

The same way that we leapfrogged traditional payment systems with mobile money and become a case study to the world we strongly believe the same can be done with digital commerce.

Tanzania can surprise the world and transform from being a laggard in indices to a leader.

To Duka Direct, Sarafu and all the other players that operate in this space — I respect your bet on the future and your bet on Tanzania. While we may be competitors, I believe we are fellow enablers first.

The future of distribution and retail is dependent on fixing a broken system. Upstream manufacturers and importers should take heed. Distributors and wholesalers should evolve or be prepared to be disrupted.

So why are we involved in e-commerce? Because we have to be.